For consumers, the policy and regulatory changes that need to be made to support their energy transition can be as important as the technological advances being made to enable a greener future. Indeed, creating a robust regulatory framework for everything from green product labelling to net metering, sustainable finance to electric vehicle (EV) insurance is a mammoth task.

It is also one in which the UAE has already made considerable headway, however.

Regulatory changes and innovations of a variety of types have been made or are underway, with these able to be categorised under a number of headings.

First, there is the setting of targets – the first step in outlining a country’s strategic framework. Then, there are regulations aimed at mobilising up-front investment costs, with the price of the transition often foremost in consumers’ minds. Third, the introduction of policies that facilitate new energy generation, transmission and distribution, allowing the growth of prosumers and distributed energy networks.

In addition, a fourth step is that of producing standards and ensuring that products and practices meet them. This can include anything from accurate labelling of power consumption on a dishwasher to making sure ‘green’ products really are sustainable and not just ‘greenwashing’.

In this regulatory space, too, lie rules and laws governing environmental protection and the monitoring and measuring of emissions, pollution, water and land use. In this area, AI also has a growing role, with monitoring and management of a mass of complex environmental data increasingly the business of AI systems. These, in turn also require a regulatory framework fit for purpose. [1]

Finally, there are also the regulations necessary to ensure that consumers are aware of the choices they have and the need for the energy transition itself. In this category lie educational programmes, training courses and research and development programmes that benefit the energy transition.

In all of these categories, the UAE has been making progress in recent years – although more, naturally, needs to be done. For consumers in the Emirates, however, the regulatory space is becoming ever more clarified and fit for purpose.

An overall, strategic plan for the transition – the UAE Energy Strategy 2050 – sets out long-term targets for emissions reduction and changes in the energy mix.

Launched in 2017, the plan aims for carbon dioxide (CO2) emissions to be cut by 70% over the plan period, while renewable and nuclear energy capacity will increase by 50%. At the same time, final energy demand will fall by 40%, implying considerable focus on demand management and energy efficiency, areas in which consumers are in the frontline. [2]

The UAE Green Agenda 2030 then sets out five strategic objectives for the development of a green economy. These include social, environmental, educational, and energy efficiency goals, including waste to energy, sustainable transport and integrated power and water management. [3]

In addition, the UAE National Climate Change Plan 2017-2050 also looks at effective management of greenhouse gas (GHG) emissions, diversification and how to adapt to climate change. [4]

Now, in 2025, the Federal Law on the Reduction of Climate Change Effects is also due to take effect from May 30. Under this, the cabinet will set annual emissions reduction targets for each sector, while the Ministry of Climate Change and Environment (MoCCaE) will determine the particular GHGs to be measured and monitored. Incentives will then be offered to emitters to reduce their emissions, including via carbon offsetting and emissions trading. [5] This dovetails with the new National Register for Carbon Credits, launched in December 2024. Under this, the UAE Securities and Commodities Authority will regulate trading, with all entities annually emitting more than 0.5 million metric tons of CO2e required to register. [6]

At the same time, the administrations in each emirate have also had a major role to play in establishing flexible rules and mechanisms fit for the purpose of successful energy transition in their particular locale.

Dubai, for example, has its Clean Energy Strategy, which targets 75% clean energy by 2050. This is only one of five aspects of the Strategy, however, with the others including targets on infrastructure, legislation, funding and human resources. [7] The emirate also has a Dubai Air Quality Strategy 2030 in preparation, following on a similar 2017-2021 strategy which targeted 90% ‘clean air days’ – those that met air quality targets – by 2021. [8]

In 2023, ahead of COP28, Abu Dhabi’s Department of Energy (DoE) launched its Energy Outlook 2050, which aims to raise the renewable energy level from 40% to 60% by 2035 and a carbon neutral economy by 2050. [9] In addition, the emirate has rolled out a range of associated decarbonisation policies and regulations. These include the Clean Energy Targets 2035 strategy, the Regulatory Policy for Clean Energy Certificates, the Policy for Energy Production from Waste, the Regulatory Policy for EV Charging Infrastructure, the District Cooling, Recycled Water Policy, a demand side management strategy, and a series of key position papers on hydrogen and energy market reform.

Ras Al Khaimah (RAK), meanwhile, has its Energy Efficiency and Renewable Energy Strategy 2040, which targets 30% electricity savings, 20% water savings and 20% renewable energy generation by the plan’s end. [10]

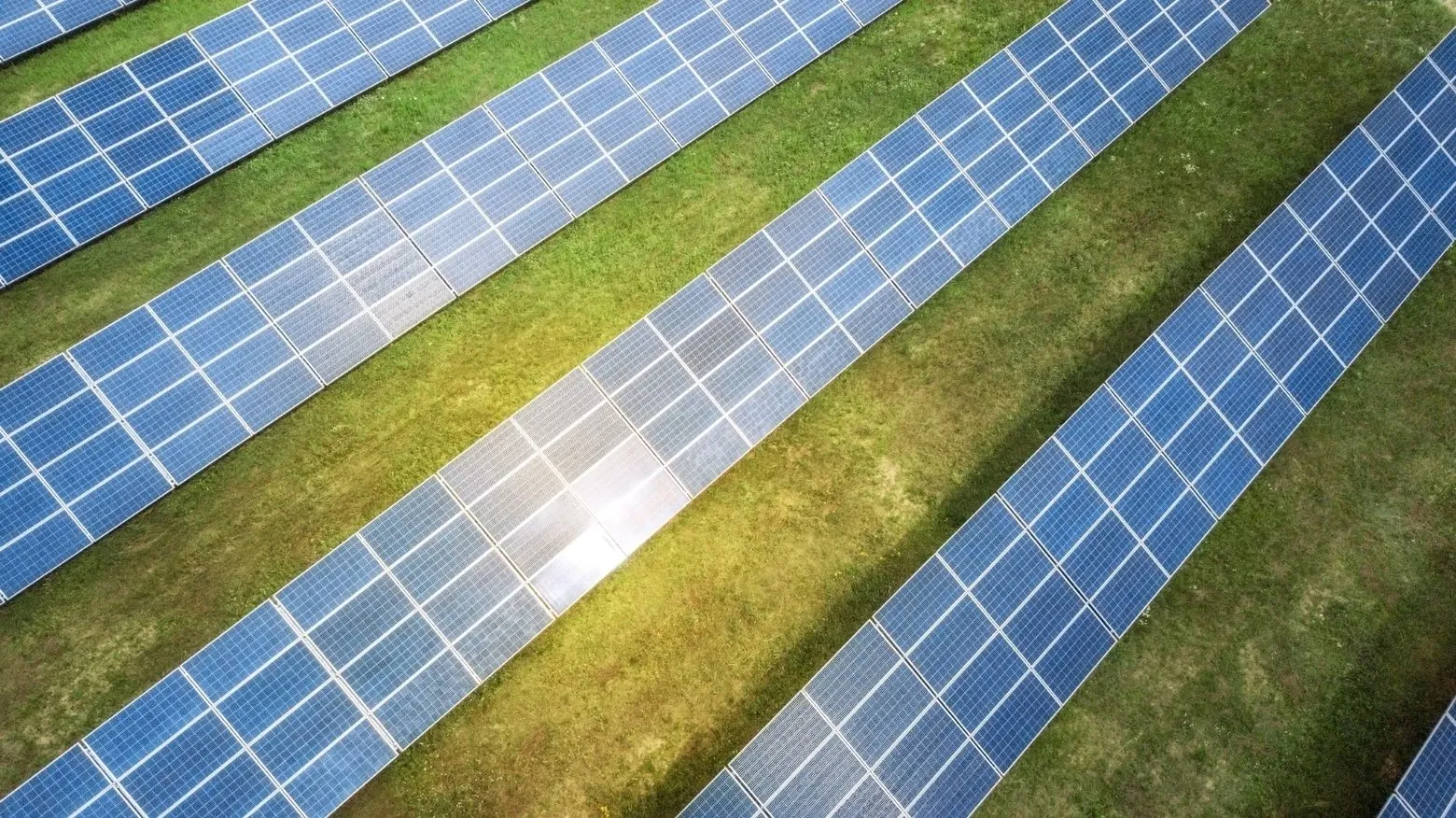

Sharjah, meanwhile, has moved forward with particular projects, such as the Sharjah Sustainable Financing Framework, [11] the Bee’ah waste-to-energy project [12] and Sharjah Sustainable City. [13] In July 2024, the Sharjah National Oil Company (SNOC) and Emerge – a joint venture between Masdar and EDF Group – also broke ground on a 60MWp solar PV plant in the emirate. [14]

RAK, Fujairah, Ajman and Umm Al Quwain come under the federal Etihad Water and Electricity (EWE) authority, which has been charged with much energy transition strategy in the smaller, Northern Emirates. EWE – previously known as the Federal Electricity and Water Authority (FEWA) – has also announced plans to focus on energy savings of 10-30% in public buildings, with an emphasis on heating, cooling, ventilation and operational efficiency, based on cloud analytics. [15]