WET: In the last five years we have seen the term energy transition everywhere. What does it mean to you and to DNV?

Jan: The energy transition is one of several transitions, including digital, that are going on in parallel globally. As DNV we focus on the energy transition as the defining challenge for the industry. We publish an annual Energy Transition Outlook (ETO) report on how the energy system will develop based on our in-house modelling and research. We have been publishing this report annually for several years now. The latest edition of the ETO report was launched in October 2024. Reference: https://www.dnv.com/energy-transition-outlook/

WET: What were the main findings of the 2024 ETO?

Jan: The model that our expert teams have built and are refining each year looks at global energy systems broken down into 10 regions. We model the supply and demand forecasts in those regions. I will describe the five main findings from this year’s report.

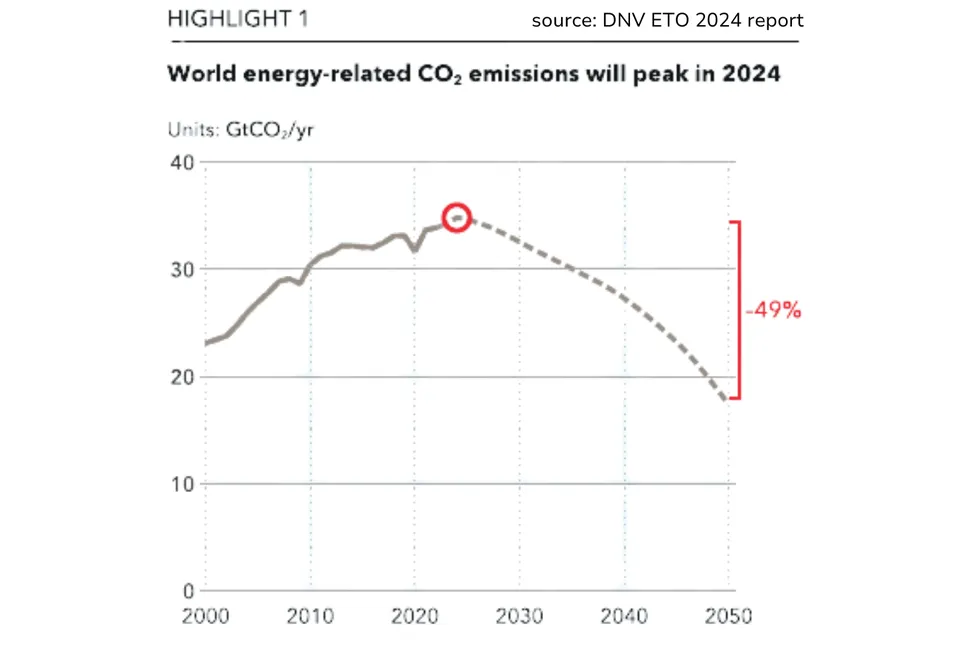

While emission reductions are unlikely to be sufficient to keep the rise in temperatures below the 1.5C targeted in the Paris Agreement, we are likely to see global energy-related emissions peak this year, and to fall going forwards. We had seen a steady increase in all previous years. So that’s number one.

The second key finding is the relatively slow progress of decarbonisation in hard-to-abate sectors, whereas electrification have seen rapid improvements this year. This electrification story is driven by continued significant cost reductions, specifically for solar panels and batteries.

China is playing a significant role in the energy transition, both as a main emitter of energy-related CO2 and as a key driver of lower-cost technology development which is speeding up the transition in certain sectors. We see China developing, implementing solutions and driving rapid growth in electric vehicles. We see tremendous uptake and implementation of solar capacity there. That’s another top finding in the ETO.

The next highlight concerns national policies on energy security considerations and how they dominate the international agenda and in parts slow down the transition.

The last of the five areas is that market mechanisms alone are not sufficient to advance the energy transition and implement emissions reduction measures quickly enough. We see a need for more intervention and regulation to align energy policy with the climate goals. The correct balance has to be found between incentivising emission reductions and regulation.

We compare and benchmark against the forecasts of other organisations. A key difference is that they tend to publish various scenarios. We only publish the one outlook we believe is most likely based on our insight and modelling of supply and demand, current technologies and so on. We find that very useful in the debate with organisations such as yourselves or our customers. So, you can disagree and challenge, and for example the International Energy Agency may have a slightly different outlook, and there is value in the debate around that.

WET: Can you tell us about the partnership model between consumers, producers and regulators, and DNV’s role in it?

Jan: We are an independent expert advisory organisation. We work with consumers, producers and regulators to facilitate this partnership of all the actors. Part of our purpose is to de-risk technologies and build trust in implementation, not least to enable the financial sector to invest in new solutions and projects at scale.

Our role is also to share knowledge and best practices with all stakeholders. So DNV is facilitating a lot of technology research. We bring operators and contractors into joint industry projects to work on transition-related challenges and create solutions, which we then package into DNV Standards and Recommended Practices and make them available to the industry free of charge.

The energy transition is not happening fast enough to achieve the Paris Agreement goals, and needs to be accelerated. This is where we have a role in helping companies deploy and scale new technologies in the market with an assurance by DNV that confirms trustability and compliance with the relevant standards.

WET: Do you see any action resulting from the UAE Consensus that emerged from the UN’s COP28 climate conference , moving forward?

Jan: This is a good example of how action requires collaboration. At COP28 here in the UAE, there were a handful of significant outcomes. The consensus around transitioning away from fossil fuel in an equitable and controlled manner was a landmark agreement compared to earlier COP’s.

Following COP28 over a year ago, at COP29 — which was held in November in Baku — we saw the publication of the first baseline report from the Oil and Gas Decarbonisation Charter (OGDC). - More than 50 oil and gas producers have joined and endorsed this group, representing 45% of global production, making it a significant voice in the industry. They have established their climate commitments and decarbonisation plans, which is a tangible outcome of COP28. It is worth mentioning, that for this baseline report DNV actually provided the independent verification assessment to confirm consistency with the decarbonization charter commitments.

Another relevant outcome of COP28 was the commitment to triple renewables implementation globally and double energy efficiency – triple up and double down! In this effort DNV is supporting our customers globally, and specifically here in the Middle East , where we are on a steep growth curve in terms of renewables, but also in China and Europe.

WET: I think last year we established that hydrocarbons are necessary. When it comes to carbon emissions and carbon capture and storage (CCS), what is your perspective?

Jan: We agree that hydrocarbons will remain an important part of the energy mix. This prediction is part of the ETO every year, and it has been proved correct each time. The most likely scenario we see is that hydrocarbons will make up around 50% of the world primary energy supply in 2050 and non-hydrocarbon sources will contribute 50%, compared to the current 80:20 mix. Absolute energy demand has grown tremendously over the past decades and is flattening out now. So, we are predicting substantial growth in non-hydrocarbon sources.

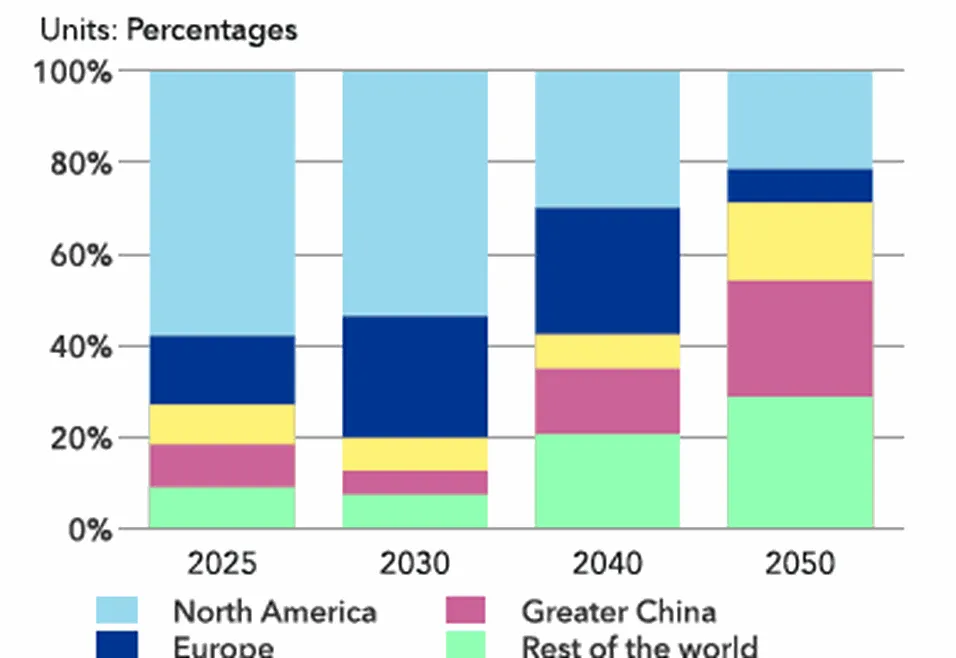

CCS is an area where we believe more needs to happen in order to achieve climate ambitions. The technology is available, and needs further scaling and implementation. We anticipate that the Middle East and North Africa, a region abundant in fossil fuels, will see its share of globally captured carbon increase from 5% in 2025 to approximately 20% by 2050. Other geographies like China will also see substantial growth.

DNV has been active in the CCS space for many years, supporting projects with our independent advisory and certification work.

Uptake has been slow in the past but we are seeing an increase now, globally and in the Middle East. We are supporting a first CCS project here in the UAE, working with a local energy major to certify a site. We are also working with similar projects in neighbouring countries. So, there is an appetite, and we are confident that growth in CCS in the region will be an important part of the decarbonisation of oil and gas production, especially here in the Middle East. The national oil companies of the UAE, Oman, Saudi Arabia and Qatar are all looking at pilot injection and capture projects.

We verify compliance with international standards in low-carbon products that are based on CCS. The off-takers want to have evidence that the carbon has been safely and sustainably sequestered.

This is a good segue to the role of transformative technologies in general. CCS technologies are going to be needed but there are many others, and they all need to be scaled and deployed in parallel, we cannot just focus on one solution if we want to get close to the Paris Agreement targets. Mitigating methane emissions is also critical for the oil and gas sector. The region has seen big investments in onshore wind, and is seeing great uptake in battery storage.

There are many examples - anything related to efficiency and scaling in electrolysis and the production of low-carbon hydrogen will be an important transformative technology.

Digital technology and innovations are going to transform how we decarbonise the energy sector and reduce emissions. So, in digital solutions and AI-enabled tools too, DNV is facilitating collaboration and sharing knowledge. DNV is verifying these algorithms and the data quality. We have published Recommended Practices to enable operators to benchmark quality levels and generate trust in these digital solutions among stakeholders, banks and customers. The UK government recently adopted DNV’s Recommended Practices on AI-enabled systems, guiding their industrial sector.

6.Can you elaborate on how the decision-making process is changing in relation to core environmental or energy efficiency priorities?

The three key dynamics DNV wants to have an impact on are scaling renewables, increasing the capacity and resilience of the electrical grid, and decarbonising oil and gas.

There is a tremendous focus on renewables in the Middle East now. It came out of COP28 as a commitment on paper and some of our local customers, including Masdar in Abu Dhabi, are more than tripling their portfolios. Some of the world’s largest single-site solar projects are being implemented in the Middle East and the UAE. At the moment there is availability of capital, the political will and the commitment from the nations and the energy companies to make that change. The technologies are maturing, the cost of solar and batteries are coming down, and major projects are being implemented.

A lot of things are happening in relation to the electrical grid too. DNV is facilitating the implementation of innovative digital tools, managing the cyber security of the grid and substations, because this is critical infrastructure. We need to build trust that digitally enabled assets are secure.